New Year, New Housing Market

Taking Stock of 2022

This year has been a rollercoaster for the Austin real estate market. After two years of verifiable madness, the market came back down to reality in the spring when the Fed started aggressively raising interest rates, which had its intended effect: to decrease buying power and demand by increasing the cost of borrowing for a mortgage. On January 1, the average 30-year fixed rate was 3.11%. The monthly payment on a $500k home, when accounting for taxes and insurance and putting 10% down, would have been around $2,900/month. By comparison, that same home on November 10 – when rates peaked at 7.08% – would have run around $3,900/month.

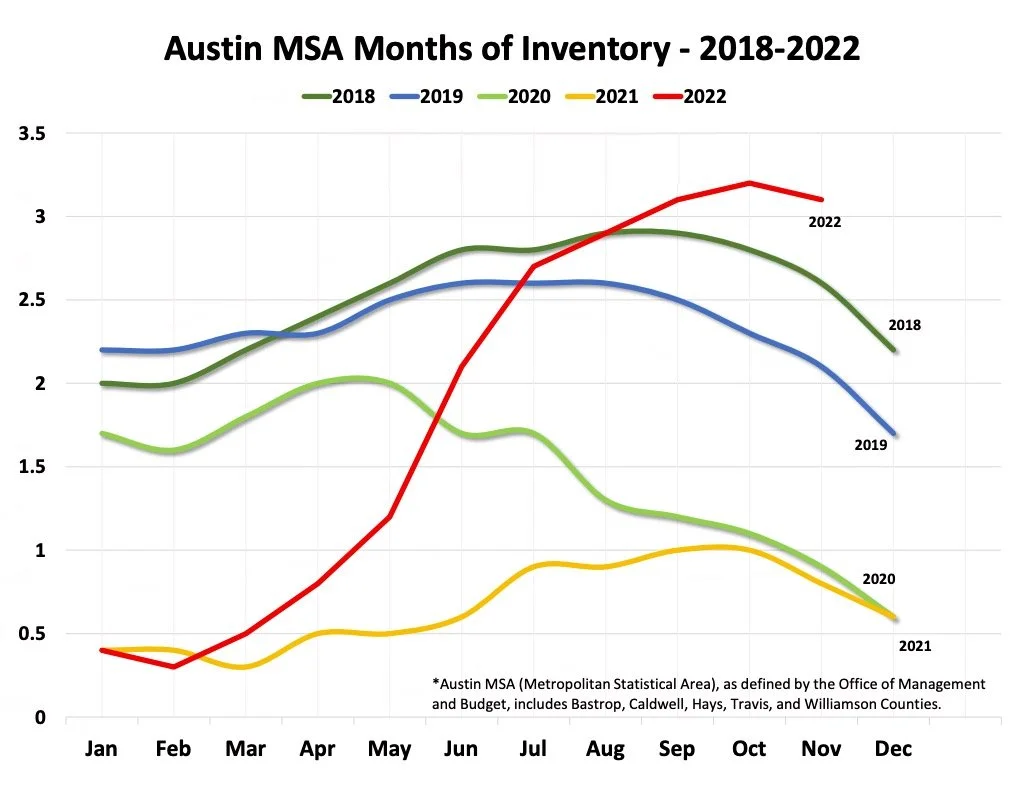

Historically, such drastic interest rate increases would have completely upended the market, but a number of factors have kept the Austin market from going bottom-side-up and have ultimately brought us to a point of stability. This is best represented through a closer look at the months of inventory that we have on hand.

Source: Independence Title Company

On the graph above, one might look at 2022 and think the sky is falling, but there are a couple of things to consider. The first is that in June and July, builders dumped over 2,500 homes onto the market. Over the past few years, demand for new construction has been so strong that builders never needed to list their inventory on the MLS. Instead, they kept everything internal and hopeful homebuyers camped out (literally) in front of their offices to get their hands on new home releases. It’s true that general resale inventory rose during that time too, but not quite as drastically as the data suggests.

Secondly, it’s important to keep in mind that a balanced market between buyers and sellers is typically when there’s about 5-6 months of inventory available. The most we reached this year was just over three months and it seems that we’ve stabilized around that mark. Three months of inventory is a healthy number and still indicates a strong seller’s market. Fourteen days of inventory was neither normal nor sustainable.

So with the interest rates suppressing demand, why hasn’t inventory gone through the roof? The primary reason is that a lot of sellers are reluctant to sell their homes at the present because they locked in such low interest rates over the past few years. This is known as the “lock in effect.” Homeowners that would have otherwise listed their homes have decided to stay put and cling to their historically low interest rates. Another contributing factor is rising rent prices. Instead of listing their homes for sale, many sellers are choosing to instead rent their properties out, often at rates that cover their monthly PITI payments. The confluence of the lock in effect with rising rent prices and lots of built up equity has brought us to a point at which one home is being withdrawn from the market for every two that sell.

Looking Ahead to 2023

Since September, the market has begun to stabilize. Inventory has peaked, prices have flattened out, and interest rates have come back down – in the past two weeks, I’ve had a couple of well-qualified clients lock in 30-year fixed rate mortgages in the upper-5s.

Source: Independence Title Company

In the past, this type of winter has lent itself to a busy spring – and I still believe that to be the case – but there’s a lot of macro-level economic chatter to sieve through. Our current economic state is replete with contradictions: inflation remained stubbornly high, but the November numbers were much better than expected; after six months of contraction, the U.S. economy grew 2.6 percent in Q3; unemployment is holding strong, but some companies have announced layoffs; and the Fed has backed off the 0.75 percent rate hikes, yet expects to continue the increases through 2023 – the list goes on.

If we do slip into recession in late 2023 or 2024, it won’t be like 2008, and the housing sector won’t be the hardest hit. There are three reasons to suggest that our housing market is stronger now than it was in the lead up to 2008: lending standards are much stricter, most people have substantial equity built up in their homes, and inventory is much tighter.

On top of that, keep in mind the factors that boomed the Austin real estate market to begin with. It all starts with jobs. We have one of, if not the, most robust job markets in the country. And with those plentiful, well-paying jobs comes in-migration. Austin is still the fastest growing big city in the country. And with all those people moving here comes the demand for housing. As long as there is demand for housing, property values will remain strong.